Demystifying UCP 600: an insider’s look at rules underpinning the letter of credit

The letter of credit may be one of the most important types of documents in the world underpinning vast amounts of the internationally traded goods that we enjoy today.

Despite its ubiquity, however, the rules and best practices for using this critical document can take time to grasp, even for some that are well-engrained in the international trade sphere.

The letter of credit from 10,000 feet

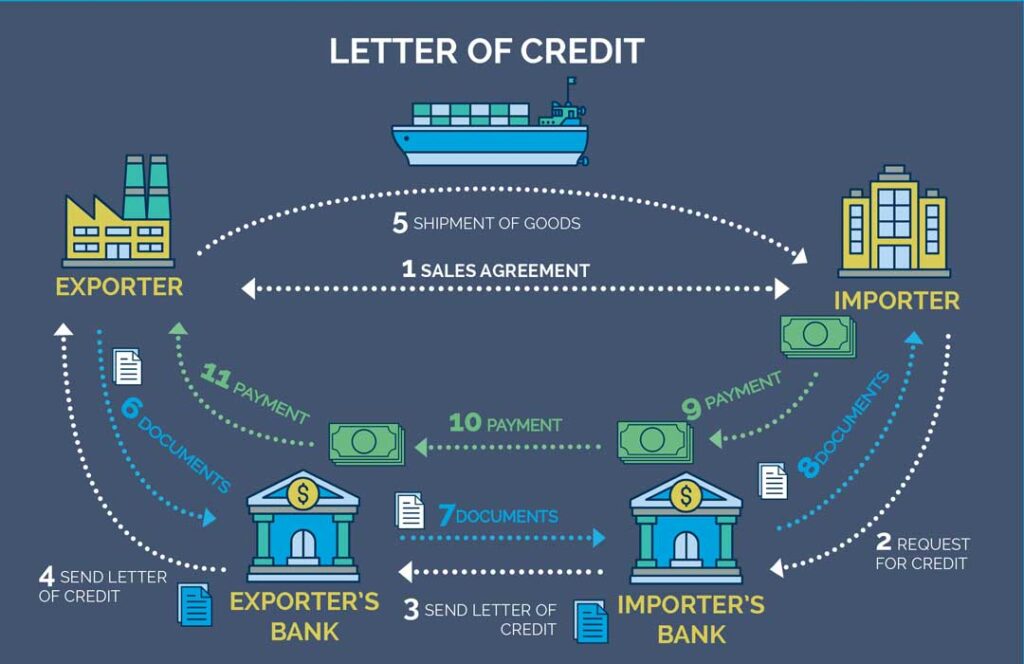

At a high level, a letter of credit is a financial instrument that enables trade and trade finance to happen by providing assurance to both the importer and exporter in an international transaction.

It is a letter from a bank to the beneficiary that guarantees payment to the exporter if the exporter can provide the documents specified in the letter of credit.

This helps mitigate the risk of non-payment for the exporter and provides assurance to the importer that they will receive the goods they paid for and the necessary documents for customs clearance.

A letter of credit also helps ensure that the imported goods comply with regulatory requirements and international trade agreements.

Taneja said, “The simplest definition I learned was it is just a letter addressed to the beneficiary by a bank. ‘Dear sir, if you ship the following cargo to my client and present the following documents to me, I hereby undertake to pay you provided the documents are in accordance with what I am asking for.’”

Overall, a letter of credit helps facilitate international trade and mitigate the risks involved in cross-border transactions.

The rules governing letters of credit

The Uniform Customs and Practice for Documentary Credit rules are a set of international rules created by the International Chamber of Commerce (ICC) to provide clear and standardised rules for using letters of credit issued by banks worldwide.

These rules were first developed in response to the need for a clear and consistent framework to minimise misunderstandings and disputes between parties involved in international trade, particularly due to large geographic distances as well as language and cultural differences.

The various renditions of the UCP rules have been given a statutory basis by certain countries and can be subject to local laws if they conflict with the provisions therein.

The rules define the roles and responsibilities of the parties involved in a letter of credit transaction, including the importer (applicant), the exporter (beneficiary), and the banks.

UCP 600

UCP 600 is the latest revision of the UCP rules, and it was developed to address issues with the previous version, UCP 500.

Taneja said, “To understand UCP 600 I always suggest you know UCP 500. But to know UCP 500, you must know UCP 400, and so forth. Each rendition is an improvement on the disadvantages of the previous.”

The main disadvantage of UCP 500 was the use of imprecise interpretative terms and phrases, which led to disputes.

For example, UCP 500 stated that a bank should examine documents presented under a letter of credit with reasonable care and within a reasonable time.

However, it did not provide clear definitions for these terms leading to inconsistent interpretations and disputes over the examination period.

To address these issues, UCP 600 removed the term “reasonable”, adding a maximum period of five banking days for banks to examine the documents.

The UCP 600 rules benefit all parties involved in international trade transactions, including banks, negotiating banks, importers, and exporters.

The rules provide a clear framework for processing and examining documents, reducing the risk of disputes and delays.

By creating a more standardised process, UCP 600 enables banks to conduct their business more efficiently and effectively, benefiting importers and exporters by reducing transaction costs and increasing trade.

Is there a need for a UCP 700?

There have been criticisms of certain provisions of UCP 600, and some experts have been discussing the need for a revised set of rules for a long time, with some hinting towards the creation of UCP 700 rules.

However, the Executive Committee of the ICC Banking Commission has reviewed this and concluded that there was no justification for revision, Besides, it is a very expensive exercise to revise UCP 600, involving not just changing the publication but also efforts to assist with implementation, training, and system alignment.

Furthermore, there are some practical limitations involved with fixing some of the discrepancies, such as late shipment, late presentation and LC expired, that exist in the current regime will remain even if UCP rules are revised.

Taneja said, “You can’t do anything about a discrepancy like late shipment or late presentation of documents, for example. A significant number of documents are rejected globally based on these particular discrepancies. Even if you revise UCP, you can’t fix that.”

Despite criticisms, the ICC Banking Commission’s Executive Committee announced in 2017 that there is no need to revise UCP 600. Banks have happily accepted it, making it unlikely that there will be UCP 700 rules anytime soon.

Practical tips for using UCP 600

Taneja provides some general and practical tips for those in the trade finance community using the UCP 600 rules to conduct their international trade and trade finance practices.

For exporters and beneficiaries:

- Understand the definition of “complying presentation” in UCP 600.

- Ensure compliance with the terms and conditions of the letter of credit.

- Understand International Standard Banking Practice (ISBP) 745, which complements and accompanies UCP 600 in articulating how the rules are to be applied.

- Review the conditions of the LC thoroughly and seek amendments if necessary before proceeding with the shipment.

- Create checklists to ensure compliance with UCP 600 and the LC terms and conditions.

For issuing banks:

- Make LCs simple and avoid giving excessive details to prevent problems for exporters, importers, and the bank itself.

- Consider the interest of all parties involved and avoid creating complexities that may hinder successful transactions.

For advising and confirming banks:

- Conduct some basic checks to ensure compliance with sanctions laws and regulatory expectations including dual usage of goods, and price checks to avoid instances of overpricing/underpricing, i.e., Trade-Based Money Laundering (TBML).

- Ensure that the LC is workable when confirming it.

These simple ideas can improve understanding of and compliance with UCP 600, leading to the facilitation of trade finance transactions and smoother international trade.